Costs Matter!

December 8, 2022 - 2 minutes read

Posted by James Spencer

Hopefully, the headline of this note will not come as a surprise to you. It is remarkable, though, just how relaxed some investors are about letting others dip their hands in their pockets to extract high fees.

The problem has two root causes. The first is that in most walks of life, paying higher costs should help you to secure the best lawyer, architect or builder, yet when it comes to investing this relationship breaks down. The second is that costs of, say 1% p.a. do not sound very much, but unfortunately they are when compounded over time as we shall see.

Unfortunately, the vast majority of active managers, who promise to beat the market, fail to deliver on their promise. It’s something we feel passionately about, you can read about our transparent, fixed fee approach to fees here.

High costs are a contributory factor to this failure. Surprisingly to some, picking funds by their costs is one of the few useful metrics available to us. Research by Morningstar – a firm that makes a living providing star ratings for mutual funds – confirms this:

‘If there’s anything in the whole world of mutual funds that you can take to the bank, it is that expense ratios [i.e. ongoing charges figure or OCF] help you make a better decision. In every single time period and data point tested, low-cost funds beat high-cost funds.’

A recent piece of research on US mutual funds reveals that the relentless drag of costs makes a meaningful difference to investor outcomes. It ranked equity funds – over 20 years to the end of 2021 – into low and high-cost quartiles, of those with the lowest costs (0.84% p.a.) 31% were ‘winners’ (i.e. beat the benchmark) and of those with high costs (1.75% p.a.) only 6% were ‘winners’.

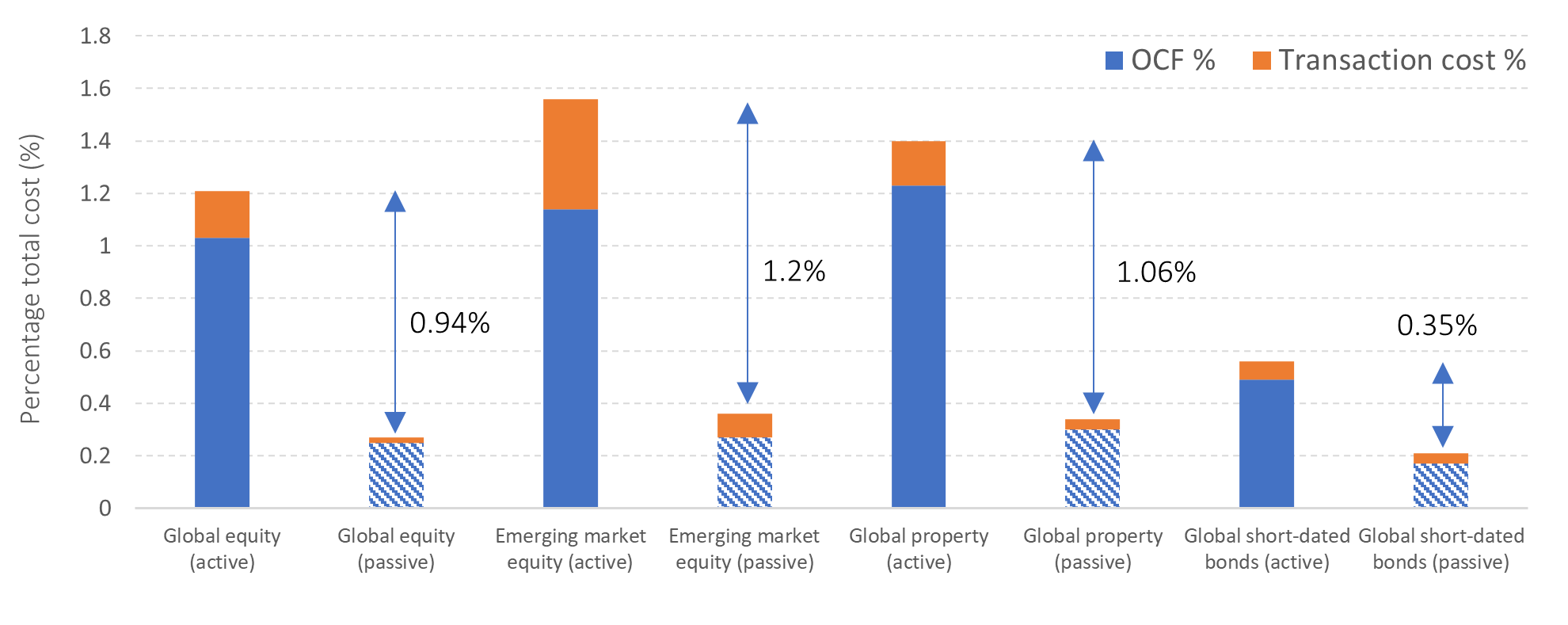

Similar results were observed when funds were ranked by trading costs (incurred through buying and selling). In the UK, there is still a big gap between the ongoing charges figure (OCF) of active and passive (index) funds, and also reported trading costs, which recent research from Albion (2022) reveals. This is illustrated in the figure below, showing average fund costs.

Source: Albion Strategic Consulting – Governance Update 24. Fund data from Morningstar Direct © All rights reserved.

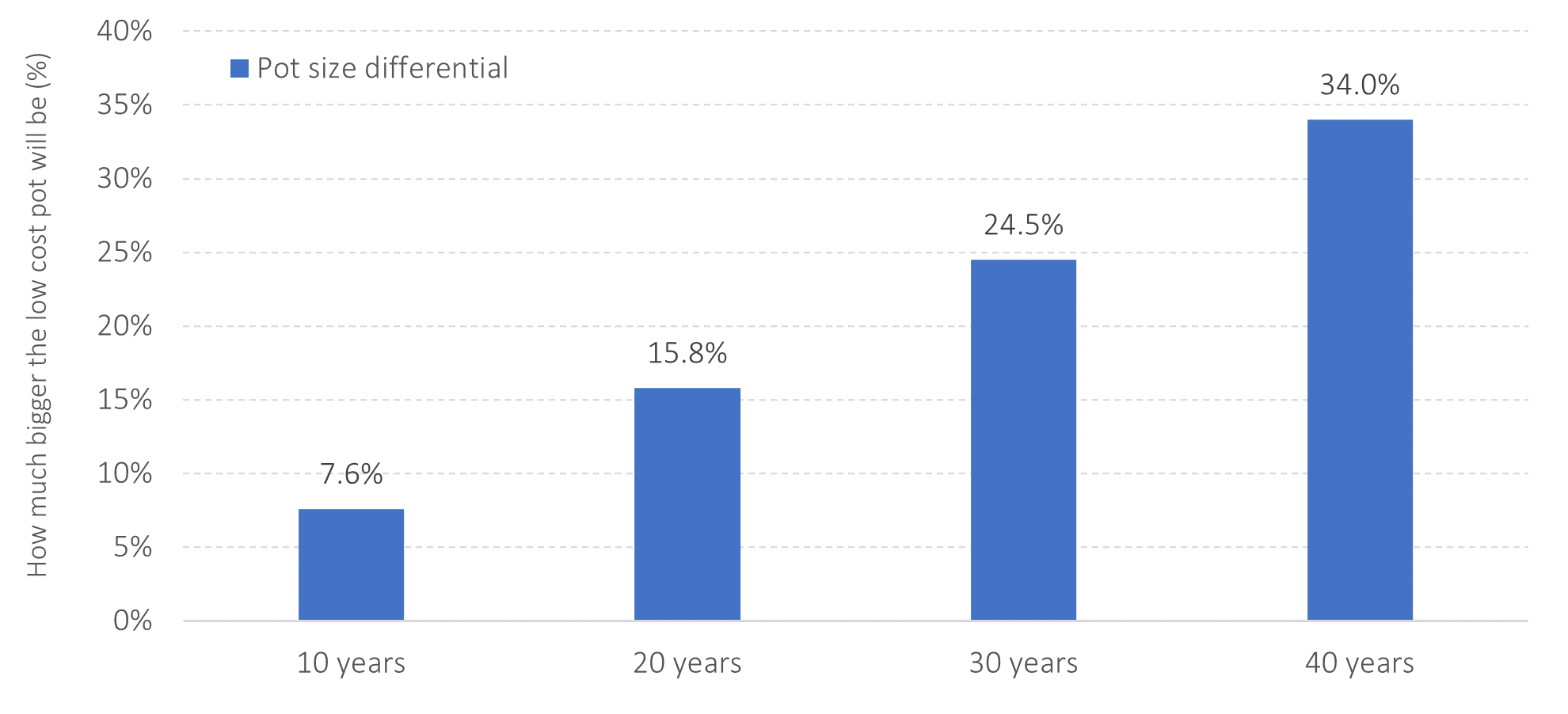

If we construct a simple illustrative portfolio with 48% in global equities, 6% in emerging market equities, 6% in global property REITs and 40% in global short-dated bonds, the portfolio level fees are 0.98% for the ‘high cost’ active fund version and 0.26% for the ‘low cost’ passive (index) fund version. With some straightforward maths , we can calculate the difference in wealth outcomes of investing in these two cost strategies over different time horizons. For the purposes of this exercise, we will assume that the two strategies earn the same return, which is favourable to the active funds, as most deliver a return lower than the market.

Advisers who adopt a systematic evidence-based approach to investing take costs seriously on their clients’ behalf. John C. Bogle, the late founder of Vanguard and investment legend drew a powerful conclusion that investors should take note of.

‘The grim irony of investing is that we investors as a group not only don’t get what we pay for, we get precisely what we don’t pay for.’

No wonder one of his favourite sayings was: ‘Costs matter!”

Find out more about the Xentum approach to transparent fees or get in touch to book an exploratory discussion with one of our experience financial planners.