Do you know your F you number?

April 12, 2017 - 5 minutes read

Posted by James Spencer

Everywhere I look at the moment, I seem to find a business guru showing entrepreneurs how to “scale up” or “grow” or “plan your exit” and all those popular buzz terms.

I have a different phrase that needs to be addressed by a business owner – “Do you actually know your F you number”

What does the Number represent?

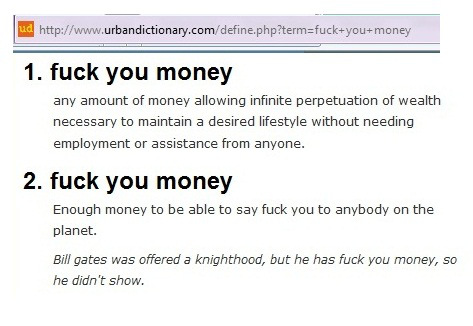

Pardon my French, but this is the F**k You number. Some call it Financial Freedom which I don’t mind either. The French version is better though

This is the number where you can:

-

Be confident that you and your family have enough if your business struggles

-

Be comfortable taking time off, knowing that your lifestyle won’t be affected.

-

Know that you won’t run out of money whatever happens

-

Be able to adapt to any surprises both personally and in business

-

Have enough liquidity to take advantages of potential opportunities

-

Not have to keep on grinding every day to stay ahead

This number could be a lump sum or an income that you feel in control of.

Steps to getting your own Personal Number

-

Understand your “desired” living costs

This is the starting point for working out your number, It is really important to know the life that you want to live going forwards and be honest with yourselves. Don’t compromise on this point as you are building a business to give you this financial freedom. Nearly all of my conversations with clients start out with this crucial point.

Look at it as three elements –

-

What are your Basic living expenses likely to be and this mainly consists of keeping your home and your family (if you have one) – Rent, mortgage, airbnb, phones, utilities, broadband, food and drink etc..

-

What are the Leisure things you want to do. This is having a personal trainer, going on holidays, being a member of a gym or just what you consider a hobby or something you are interested in. These are the things that can be cut out without affecting your standard of living but you like to do them

-

What the real Luxury things that you want to happen – this is the exciting stuff, like buying a sports car, taking a 6 month sabbatical, buying a yacht!

Once you have these elements above and you should have a monthly expense and also one off single expenses budgeted for this is the starting point to understanding your number. I have put an example below:

Basic – £5k a month

Leisure – £2k a month

Luxury – £30k one off in 2020 ( I want to go to superbowl)

Total is approx £8k-9k a month – say £100k net of income required.

Really important to stress again that this is your “desired” expenditure on things that you value, and not your current expenditure. This is all about planning forwards.

I have a free worksheet if it helps to categorise the above. Please click here and download it.

2) Work out the lump sum required

Within my profession, there is always discussion about how to calculate this number and what withdrawals are sustainable from a portfolio. I actually think that a basic rule of thumb helps here and 4% is usually the common answer the money bods come up with. I really enjoyed the Mr Money Moustache Podcast with Tim Ferriss recently where he used the 25 multiple as working out the lump sum required.

Using this 4% and 25 times rule of thumb and the example above, this would be:

£100k x 25 = £2.5million net required

For £50k it would be £1.25m

3) Put the money to work

This is where I find entrepreneurs struggle following exits. They leave money in cash and also dabble in property as they don’t have a strategy around how you can get the most from the exit. I find most people overthink this area and simple works best.

Let’s assume that you invest the £2.5m into a low cost diversified investment portfolio (wow that sounds more complicated than it really is) and take 4% every year (paid monthly) from this portfolio. History tells us that this pretty much achievable without eroding your capital over the long term.

This however assume that you minimise portfolio fees as this will eat the returns and big fees suddenly means 4% required actually becomes 6% which is a whole different ball game. Not so easy to get 6%. That is a 50% increase.

Why low cost? Well because Warren Buffett says so and he is the probably the greatest mind in the money management universe. Unless you are one of the few great minds in the world that can consistently pick winners, play the long and simple game most of the shrewd people are playing.

So there we have it, my very easy system to calculating your number:

The system:

“Understand your desired living costs + Work out the lump sum + put the money to work = F**k you money”

What about an alternative if you don’t want to sell your business for a number?

Most people are shocked when I use this example above, particularly people looking to exit. What a lot of entrepreneurs forget is the power of income, particularly income from a business they have faith in and have control in.

If you could almost guarantee that annual income without a huge amount of extra effort, would you take it?

That is a question most entrepreneurs should think about when thinking about their number. Is the answer to their financial freedom already within their business or not far away with a bit of growth and the right team.

I can tell you for a fact that nearly every entrepreneur I have come across struggles with the concept of exiting and then adopting the investment strategy I have detailed above. It is completely out of their comfort zone despite the logic.

Which route to take?

If you are reading this and you think the numbers look familiar to yours, you need to think about whether that income is already within your grasp or if the big exit is the right plan to really achieve the things you want to.

Only a couple of weeks ago I had this exact conversation with two business owners looking to “grow” “scale up” and potentially “exit”. They hadn’t worked out their number yet, so how did they know the right direction for their business. The answer could be right in front of them already, they just hadn’t looked at it this way as the whole business guru profession is telling you the same thing, but that doesn’t necessarily mean it relates to your personal circumstances.

At the end of the day, a business is purely a means of feeding into your personal financial success and how you want to live your life, or at least it should be!