Blog – Fees and Conflicts in Financial Advice

October 18, 2016 - 4 minutes read

Posted by James Spencer

Everywhere I look, I see ways to save money. I see utility companies falling over themselves to get my business. Only this week I switched from Sky to BT and pocketed £130 through a cashback site. You cannot breathe in the modern world without some kind of sale getting you to part with you hard earned cash.

Where I don’t see it yet is personal finance and although the profession is getting better at being transparent, it isn’t being discussed enough. People generally don’t know what is a good deal and bad deal in personal finance, especially business owners who frankly have better things to do. I am therefore writing this blog slightly out of frustration as every client I come across these days seems to have been flogged a bad deal at some point and hopefully this improves awareness.

As I have explained before I prefer to work on monthly fixed fees when working with business owners, particularly those under 45. My job is to navigate the market on behalf of the client that pays me and I can tell you that it is a murky old world out there. Some companies (I won’t name names) have been prioritising the shareholders over clients for years.

So let’s start with an example.

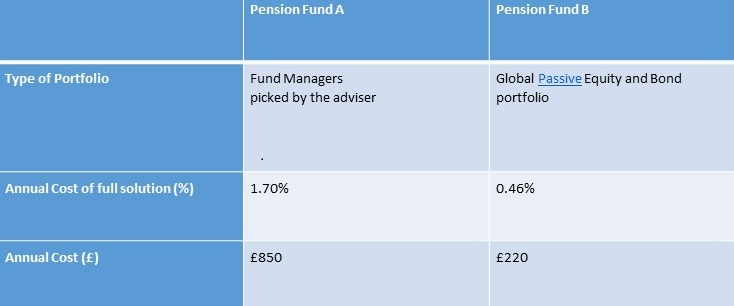

Client A is 35 and has a pension pot of £50,000.

Let us assume that he or she wants to take some risk and wants to grow the capital over the next 25/30 years and there are two pension fund solutions.

This is a real life example of a case I did recently and funnily enough the client hadn’t heard from the adviser for pension fund A once it was setup – seems to be a fairly common occurrence.

I will make this clear – I don’t believe in active fund management for clients who aren’t looking to retire for many years, probably 20-25 years plus. My view is that the behavioural aspect of putting money into the plan or solution is more important than the returns and trying to pick winners is a losers game. This is a view backed up by one of the greatest investment professionals we have ever known –

“By periodically investing in an index fund, the know-nothing investor can actually outperform most investment professionals.” Warren Buffett

Which Solution would you go for?

Therefore, guess which portfolio I recommend to my clients and which portfolio I invest in myself. You guessed it right, portfolio B for me every time and not surprisingly Portfolio B has performed way above portfolio A. The 1.24% a year head start helps! As the market becomes more technology driven I am hoping to see these costs come down even more.

What you are seeing in Portfolio A is a listed company that has to deliver profits to its shareholders every day therefore the margins need to be higher, not to mention the exit penalties stopping you from taking your money out! Portfolio B is a mutual fund with no other fees or charges and the company delivers profits back to its clients every year and has done since the 1970s. I am not going to say the names but anyone reading from the Financial Services World should have guessed by now. You might also find out what pension fund B is from reading my free money resources page.

Advising without conflict

So based on the fact that I charge fixed fees for holistic financial planning that goes way beyond just investment and pension solutions, I am always going to choose portfolio B as I have no conflict of interest. I work for the client and I sit on their side of the desk in partnership.

If you were recommended a pension or investment ask yourself whether there was a conflict of interest in your solution. Was there a target behind it or were your best interests put first and was the adviser on your side? This stuff matters and I am going to illustrate why now:

The average return for portfolio fund B over the last 20 years has been around 7.5% a year.

If you forecast this same return over the next 20 years minus the charges portfolio B would return an extra £40,524 alone. Now Portfolio A would argue that their performance would be better because of picking very clever fund managers. Although I am optimistic, let’s remember Buffett’s quote, I would prefer to bank the extra charges thank you as that is guaranteed.

And this happens across the board in financial services. It happens in investments, in protection or life insurance, it has been happening in pensions for years and also in other areas such as tax planning. It is really important to find people who do not have the conflict of interest of having to sell you something to get paid as this creates poor behaviour and a lot of bad outcomes to clients. That is why you need to question what you have and the reasoning behind it.

PS. I recently advised a client who decided to cash in his Stocks and Shares ISA to pursue a business interest that was related to his successful business. The deal was a bit of a slam dunk but if I didn’t work on fixed fees then I would have had a conflict of interest in advising him as it would have meant that I wasn’t going to be paid going forward. Thankfully as we agreed a fixed fee for my services, this potential conflict wasn’t even an issue.